Tony Studio

Investment thesis

NVIDIA is aggressively penetrating the market of data centers and cloud computing while leveraging its leadership in the dGPU segment. The company has demonstrated in the past to be highly innovative and a pioneer in the semiconductor industry, and is now doubling down with its own revolutionary accelerated computing solutions to challenge the end of Moore’s Law Era. NVIDIA is also entering the CPU market segment with its Arm-based superchip Grace and is strongly positioned in multiple future-oriented secular growth drivers. The company will likely continue to shape the standards in graphics, High-Performance Computing, and AI, and can count on a very strong moat and an extraordinary high capital efficiency. My rather conservative valuation model prices the stock’s fair value at $220, with a 23.67% upside potential from its last closing price.

A quick look at NVIDIA

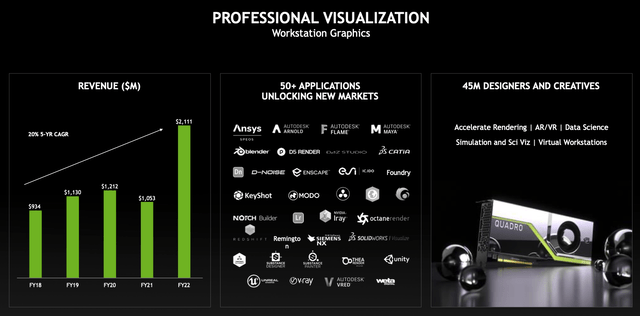

NVIDIA Corporation (NASDAQ:NVDA) is an American company that invented the Graphics Processing Unit (GPU) in 1999 and paved the way for growth in the PC gaming market. Today, NVIDIA’s systems are installed in several hundred million computers, are available in every cloud, power 355 of the TOP500 supercomputers, and are now set for accelerating the development of modern Artificial Intelligence (AI), the next era of computing. The company evolved from a chip vendor to a computing platform and operates through two business segments, Graphics, and Compute and Networking. In its Graphics segment, NVIDIA offers GPUs under the brands GeForce, Quadro/NVIDIA RTX for PCs, game consoles, video game streaming platforms, enterprise workstations, vGPU software for cloud-based visual and virtual computing, GeForce NOW game streaming service and infrastructure, laptops, desktops, gaming computers, and peripherals, as well as the Omniverse real-time graphics collaboration platform for building 3D designs and virtual worlds. Through its Compute and Networking segment, the company provides systems for AI platforms and solutions, High-Performance Computing (HPC) and accelerated computing, data center platforms and networking solutions; platforms and solutions for autonomous and intelligent vehicles, cryptocurrency mining processors, embedded computer boards for robotics, and solutions for enterprise artificial intelligence infrastructure. The company was founded in 1993, is headquartered in Santa Clara, California, and employs over 23,700 employees worldwide. Its most important geographical regions by its customers’ attributable revenue are Taiwan, followed by China and the United States.

Author

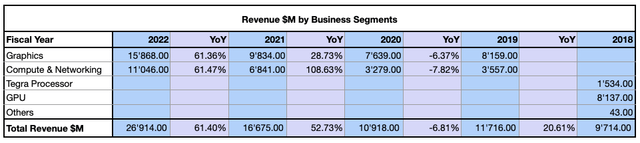

The company’s success relies on multiple secular growth drivers with gaming being the most important with 46% of the revenue in the past year and a 25% Compound Annual Growth Rate (CAGR) over 5 years. NVIDIA counts more than 200M gamers using its GeForce technology and is the global leader for Discrete Graphics Processing Units (dGPU) with a market share of 78% in Q1 2022, followed by Advanced Micro Devices, Inc. (AMD) with a market share of 17%.

NVIDIA

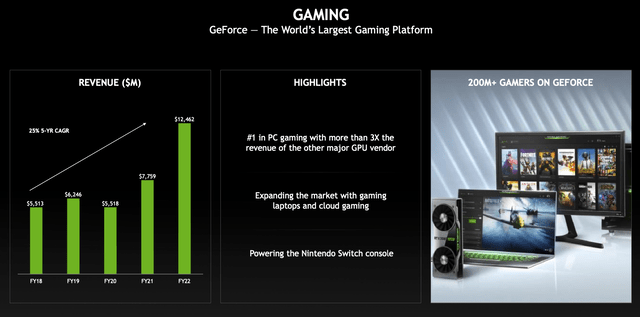

Data centers are the second most important growth driver and also the fastest growing, with 66% CAGR and 40% of the revenue in FY22, NVIDIA is a leader in supercomputing, deep learning, and AI platforms and solutions.

NVIDIA

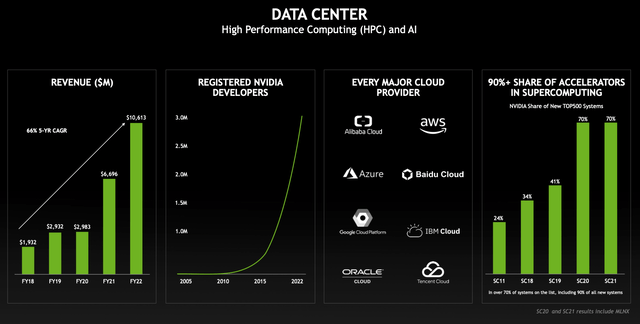

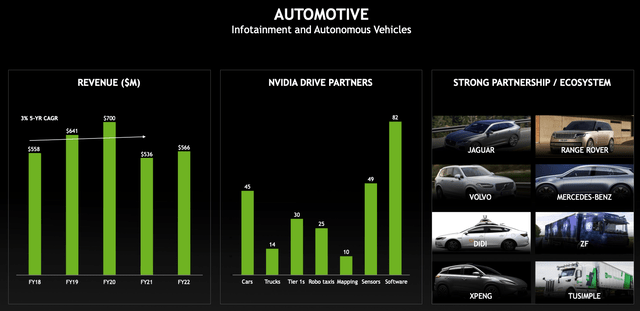

Professional visualization and Automotive are two other growth drivers for the company, with respectively $2.1B and $566M revenue in the last year, and a 5-year CAGR of 20% and 3%.

NVIDIA

While the Automotive market is still relatively small for NVIDIA, the company reported over $11B in design wins in its pipeline and offers complete hardware and software solutions for autonomous vehicles, a segment that will likely grow much faster in the coming years.

NVIDIA

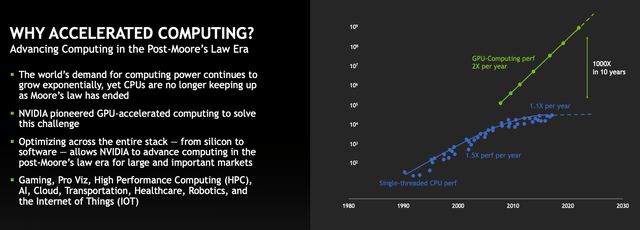

The end of Moore’s Law

In 1965, Gordon Moore, co-founder of Intel Corporation (INTC), affirmed that, due to the shrinking size of transistors to the nanoscale, the number on a microchip doubles about every year, while the cost of computers is halved. After 1975, the estimate changed to a doubling of transistors about every two years. While more transistors result in more powerful chips, over the past 50 years, engineers were able to systematically develop more efficient and miniaturized chips and systems with higher computational capacity, in line with Moore’s law predictions. However, chip manufacturing companies like Intel, began to delay their rollout of smaller transistors, and industry leaders are suggesting that physics and engineering capabilities have been pushed to their limits, and despite computational abilities have reached unprecedented levels even in nanotechnologies, wearables, and Internet of Things (IOT) devices, systems may have reached their limits in transistor capacity and power, hence, setting an end to Moore’s law.

NVIDIA

In 2006, NVIDIA introduced GPU-accelerated computing through its Compute Unified Device Architecture-enabled (CUDA) GPUs and challenged the limits of Moore’s law. This revolutionary approach uses parallel processing to speed up computational tasks on demanding applications, such as AI, data analytics, simulations, and visualizations. Although some open-source alternatives exist on the market, competitors introduced their parallel computing approach, and graphics processing units from NVIDIA are sometimes seen as hard to program, NVIDIA is the market leader in the accelerated computing industry.

Future growth drivers

With its three-chip strategy, NVIDIA is likely one of the best-positioned semiconductor companies for the post-Moore’s Law era. The GPU market was valued at $23.90B in 2021, and it is expected to reach a value of $130.02B by 2027, with a forecasted CAGR of 32.70%. The global data center accelerator market was valued at $13.7B in 2021 and is forecasted to grow at 31.06% CAGR through 2027 and reach a size of $69.44B. The global data center chip market reached a value of $9.56B in 2021 and is expected to grow at 6.70% CAGR through 2027, reaching a value of $14.11B. The industry is experiencing a series of consolidations in the building battle for data center chips, with AMD recently finalizing the acquisition of Xilinx, announcing the acquisition of Pensando Systems, and the failed attempt of NVIDIA to acquire Arm Holdings for $66B, which is still owned by SoftBank Group (OTCPK:SFTBY). NVIDIA has 20 years of architectural license from Arm, which grants the company to focus on its three-chip strategy involving Central Processing Units (CPU), GPUs, and Data Processing Units (DPU). The latter is the third component in modern data centers capable of parsing, processing and efficiently transferring data to GPUs or CPUs, and delivers functionalities that will define the next generation of cloud-scale computing.

NVIDIA unveiled its own 144-core CPU superchip, named after US computing pioneer Grace Hopper, based on Arm-architecture, which it claims to be two times faster and 2.3 times more efficient than Intel’s Ice Lake Xeon Platinum 8360Y processor. The company announced some world-leading computer makers such as Dell Technologies (DELL), Hewlett Packard (HPE), Lenovo (OTCPK:LNVGY), Atos (OTCPK:AEXAF), Gigabyte (ticker 2763 in Taiwan) among the early adopters of its superchip. While Intel almost controlled the entire server industry in the past and is still the leader in server chip shipments, its market share has recently shifted towards competitor AMD, which aggressively invested in that industry. NVIDIA is strongly positioned to capture a significant market share in the data center CPU market and has the advantage to offer a robust and complete platform of products and services, supported by its unrivaled leadership in GPUs.

What’s up next for NVIDIA?

Despite the gaming industry losing steam in the last few quarters, I see this trend likely to turn as soon as people will come back from the summer holidays and consumer spending will be channeled away from traveling, towards products and services consumed at home. The personal consumption expenditure excluding food and energy for people living in the United States is still at high levels, and despite a pullback in Q3 2021, it successively gained positive momentum. NVIDIA is expected to release its GeForce RTX 40 series this fall, with rumored twice the performance of its predecessor, although the company could postpone the availability of its latest GPU, as the market is currently experiencing a flood of used GeForce RTX 30 series GPUs, previously mostly used for cryptocurrency mining.

Global bottlenecks in the supply chain, increased air- and ship-freight costs, inflationary pressure on rare earth and metals, and shortages of neon gas, an inevitable component in the manufacture of semiconductors, are some of the causes of the ongoing global chip shortage. A perfect storm for chipmakers. But is that all bad news for NVIDIA? As I will show in the next section, the company has very strong pricing power, and because of the global chip shortage, some customers are ready to pay more to secure important components for their products. For the same amount of chips used e.g. in a laptop or a personal computer, in times of sourcing deficiency, a carmaker is likely willing to pay more, since its revenue is proportionally also much larger. Although the automotive industry is still a smaller market for NVIDIA, the huge increase in design wins in its pipeline is a strong sign that this industry will likely become much more important for the company in the coming years and the diversification will positively impact the company’s revenue mix.

What excites me the most in NVIDIA’s near and mid-term future is their potential in the data center industry, and in particular cloud-computing data centers, AI factories or data centers that fuel massive amounts of data to train AI models, data centers for industrial robotics and automation, edge data centers, and supercomputing data centers. Driven by the rise of remote work and learning, the fast expansion of data-intense technologies such as IoT, Machine Learning (ML), AI, blockchain, and decentralized technologies, the digitalization of business processes and the industrial digitalization as well as, the faster adoption of digital technologies by Small and Medium-size Enterprises (SME), the global data center market is forecasted to grow at 10.50% CAGR, and seen valued at $517B by 2030. The often-disregarded acquisition of Mellanox will grant NVIDIA additional market shares in this fast-growing market by supporting accelerated networking and data transfer solutions. NVIDIA’s Omniverse may be an element in the company’s product portfolio that is still quite difficult to frame in terms of its potential but is likely to be a driving force in the company’s universe. The latest announcement of Siemens (OTCPK:SIEGY) committing to NVIDIA’s platform and even expanding its partnership by connecting their Siemens Xcelerator platform, to enable the industrial metaverse and increase the impact of NVIDIA’s AI ecosystem in the industrial automation that is built using Siemens’ mechanical, electrical, software, IoT and edge solutions, is underscoring its importance. Meta Platforms (META), which is building the world’s largest AI supercomputer to power the Metaverse, and sources its chips from NVIDIA and AMD, could dramatically increase its investment in GPUs, as it faces strong competition from rival TikTok. And Meta is by far not the only customer who will have to increase its computing power, as NVIDIA powers over 70% of the top 500 supercomputers worldwide. AI-driven cybersecurity in edge data centers is another potential near-term growth catalyst for NVIDIA, with its BlueField-2 DPU real-time telemetry, and NVIDIA GPU-powered Morpheus cybersecurity framework. The average cost per data breach increased from $4.24M in 2021 to $4.35M in 2022 and security AI is reportedly providing the biggest cost mitigation, with on average $3.05M fewer expenses per data breach, for companies that fully deploy AI cybersecurity.

An insight into the industry

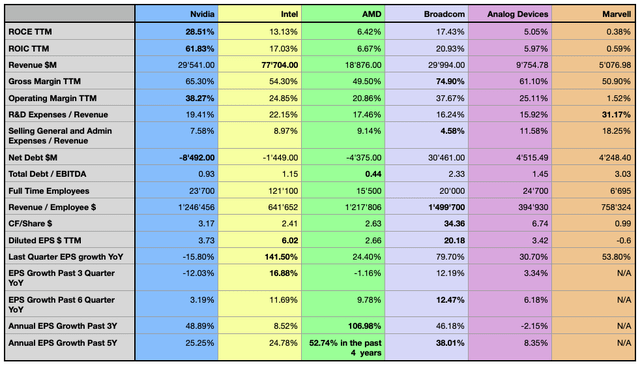

The company reported an increasing gross margin, accelerating from 27.06% CAGR over the past 5 years to 41.75% CAGR over the past 3 years and standing at 65.30% Trailing Twelve Months (TTM), outperforming the average gross margin of the analyzed peer which stands at 58.14%. While Broadcom (AVGO) reported the highest gross margin, NVIDIA and AMD could achieve the highest growth rates during the last years. In terms of operating profitability, NVIDIA reported a significant improvement of 28.64% CAGR over the past 5 years, growing 58.38% CAGR over the past 3 years, and establishing its margin at 38.27% TTM. Only AMD recorded an even greater acceleration of its operating margin over the last 5-3 years, with respectively 98.73% and 84.10% CAGR, although its margin stands at only 20.86% TTM.

Author

In terms of capital allocation efficiency, NVIDIA is by far reporting the best performance among its peers, with a stellar Return on Invested Capital (ROIC) of 61.83% in the past 12 months, while the peers’ average stood at 10.24%. I consider this metric to be a very important element when pondering an investment decision, a company must be able to consistently create value to be a sustainable investment. Nevertheless, outperforming the peer group, NVIDIA’s large spread between its Return on Capital Employed (ROCE) and its ROIC, indicates that despite the highly efficient core business, the actual returns to investors are lower because of the significant idling cash position. NVIDIA reported over $20.33B in cash and short-term investments, resulting in a large negative net debt position. NVIDIA could improve even its capital efficiency, which is very promising from an investor’s point of view.

Investments in Research and Development (R&D) are of primary importance for companies in the semiconductor and technology industry, NVIDIA is spending a relatively fair amount of 19.41% when compared to the average of its competitors, hovering around 21% on average in the past 6 years. The company reported relatively low leverage of 0.93, only AMD reported an even more conservative leverage ratio, while Broadcom and smaller competitor Marvell Technology (MRVL) recorded the highest debt exposure, but compared to its competitors, Broadcom has a very cash-rich business with by far the highest metric in terms of cash flow per share.

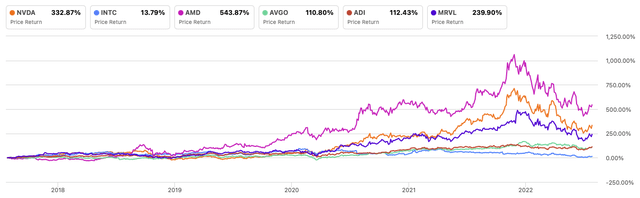

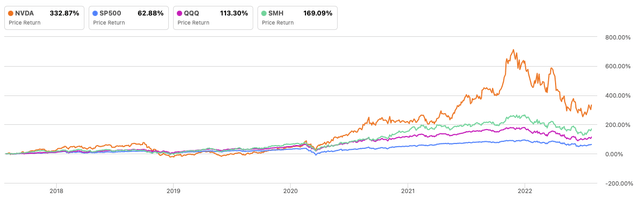

Considering the stock performance of the past 5 years, NVIDIA performed better than most of the analyzed peers, with only AMD performing even better. Without surprise, Intel is the worst performer in the group, while also Broadcom and Analog Devices (ADI) are underperforming the group for a considerable time.

Author, using SeekingAlpha.com

NVIDIA outperformed significantly the VanEck Vectors Semiconductor ETF (SMH), as well as both the QQQ (QQQ) and the S&P500 in the last two years while showing some sporadic periods of relative weakness during 2019.

Author, using SeekingAlpha.com

Although history is not a guarantee for future performance, NVIDIA has demonstrated to be highly innovative and a significant industry leader for many years. The company’s strong positioning in secular growth markets, its relative strength compared to its reference indexes and peers, as well as its highly efficient capital allocation, are just some of the elements suggesting that the company is looking towards a very promising future, by likely outperforming its peers and the market, with high potential returns for investors.

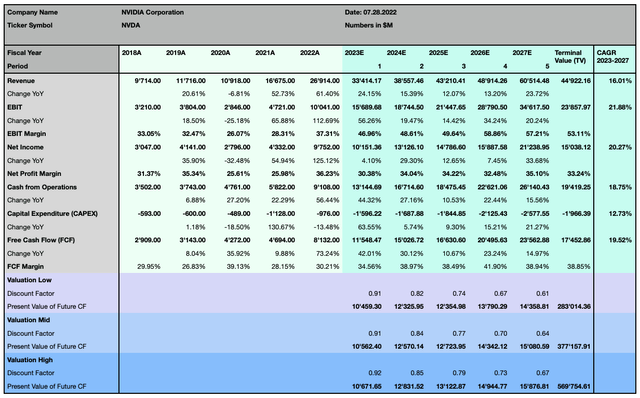

Valuation

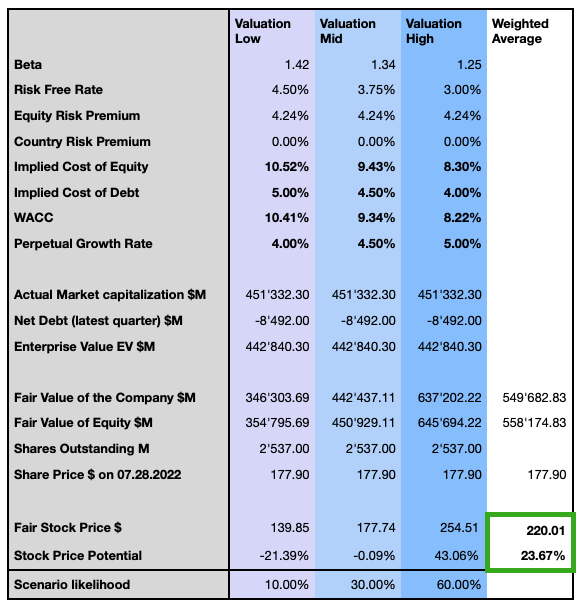

To determine the actual fair value for NVIDIA’s stock price, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, the company is anticipated to generate a consistent, solid 19.52% Free Cash Flow (FCF) CAGR over the coming 5 years, with substantially increased net profitability at 20.27% CAGR, while its revenue is forecasted to grow slightly slower, at 16.01% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be considerably undervalued with a weighted average price target with 23.67% upside potential at $220. Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Risk discussion

NVIDIA faces strong competition from well-established and innovative companies with partially strong growth and market position. Despite Intel never confirming itself in the dGPU market segment, the company is the leading GPU maker with about 60% market share thanks to its integrated Graphics Processing Units (iGPU), followed by NVIDIA and AMD with respectively 21% and 19%. Intel can also leverage its strong and broad market positioning in server chips, and its historically tight relationships with major companies worldwide, while its recent delays in delivering its newest technology and somehow the lack of revolutionary innovation, give more chances to its competitors to establish themselves and gain market shares. Apple has demonstrated the ability to develop superior chips, and despite the company seems not planning to sell its chips to other manufacturers, this has never been officially confirmed and the company’s strategy could change in the future. NVIDIA has directly profited from the huge increase in popularity of cryptocurrencies in the past years, as its GPU are largely used in the mining process; the whole market being in an apparent longer crypto-winter without any significant sign of recovery, the company’s sales could further be negatively affected. NVIDIA doesn’t own or operate a wafer manufacturing facility, and its dependency on third-party foundries located outside of the United States, like Taiwan Semiconductor Manufacturing Company (TSM), exposes the company to substantial risks in terms of pricing, politics, and manufacturing capacities. The Covid-19 pandemic has significantly impacted the whole industry and NVIDIA is no exception, as its workforce and operations and those of its customers, partners, and suppliers continue to be impacted, causing supply chain bottlenecks, and increased pricing pressure and delays.

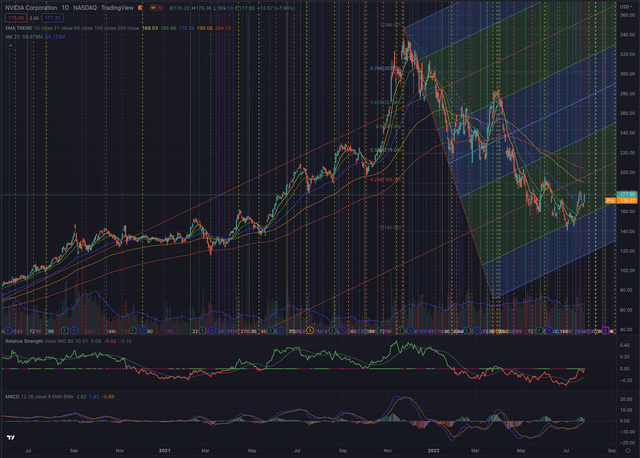

Market timing

The stock reached its ATH (All-Time-High) at $346.47 on November 22, 2021, after a long rally since the Covid-19 pandemic low at $45.17 on March 18, 2020. The stock successively retraced a significant part of its previous gains, by mostly underperforming the NASDAQ Composite, while many companies in the technology sector lost massively in value since the beginning of 2022. From a technical analysis point of view, the stock recently rebounded significantly at $140.55, by overcoming the most important short-term resistances and confirming its price level over the EMA50 with increasing volume. A great moment for swing and momentum traders. The stock successively tested the EMA50 on its last trading day in the past week, and the next market sessions will show if the EMA50 will act as a support or if the stock will retrace further its gains and continue its medium-term downtrend. It’s important to note that the stock hasn’t broken the EMA50 since its last short-term rally in March 2022. Despite this recent encouraging movement, in my opinion, the stock is now set for some consolidation, while it could also reach its next resistance levels at $189.15. A breakout over that level would need even more resilience in the momentum, the stock could then head towards its EMA200, which is now at $204.13.

Author, using TradingView

NVIDIA can count on significant institutional support among its shareholders, with 64.78% of the outstanding shares owned by institutions, a relatively low short interest of only 1.37%, and less than one day to cover. The street consensus given by 42 analysts prices the share on average at $236.08 with a buy rating, with the lowest estimation at $130 and the highest at $400. The Seeking Alpha Quant Rating instead qualifies the stock consistently as a hold position.

The bottom line

Investing in a technology company can be associated with a higher risk profile. While not always companies in this sector have a strong moat as NVIDIA has built over the past years, the stock price may be subject to higher volatility. The recent announcement of the US Senate accepting the $52B CHIPS act to support its domestic semiconductor production, is a clear sign of how important this sector is and will be in the future, where AI, HPC, data centers, and cloud computing will play an even more significant role. NVIDIA is historically a company that revolutionized the semiconductor market with its technology and is set to continue to be a leader in its established market segments and significantly grow in all its secular growth vectors. I like to define NVIDIA as the type of stock that every investor would like to own in its portfolio, and the actual market correction could be a good moment for considering a position in this company. The actual upside potential of 23.67%, pricing the stock at $220 based on my rather conservative valuation model, is motivating me enough to rank it as a buy, but I am aware of the downside risk and would in any case, as I always do set an appropriate stop-loss, based on my contingency plan.