The Trade Desk TTD noted to start with-quarter 2022 non-GAAP earnings of 21 cents per share, beating the Zacks Consensus Estimate by 31.25% and surging 50% calendar year around yr.

Revenues of $315.3 million also surpassed the Zacks Consensus Estimate by 3.59%. The prime line soared 43.5% calendar year in excess of year.

Consumer retention remained more than 95% in the noted quarter. At the close of first-quarter 2022, The Trade Desk had much more than 1,000 buyers.

The Trade Desk witnessed robust momentum around crucial initiatives like Linked Tv, Shopper Information, Unified ID 2., OpenPath and new information market.

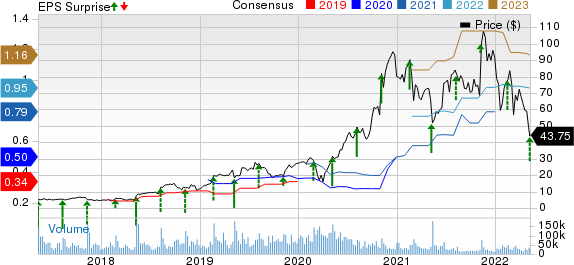

The Trade Desk Price, Consensus and EPS Surprise

The Trade Desk value-consensus-eps-shock-chart | The Trade Desk Quotation

Growing Companion Foundation

During the noted quarter, The Trade Desk declared its collaboration with LiveRamp RAMP to build European Unified ID, a new privateness-very first, interoperable resolution for the European marketing current market.

The option, based on Unified ID 2., will account for specific market requirements in Europe and the U.K., together with GDPR regulations and consent framework constraints.

As a portion of the collaboration, The Trade Desk and LiveRamp system to help bidding on RampID, LiveRamp’s privacy-first, people-based mostly identifier, within just The Trade Desk in Europe.

The Trade Desk also declared a partnership with AppLovin Application, which offers companies and advertisers accessibility to AppLovin Trade (“ALX”) — the primary in-application RTB exchange — with the addition of ALX as a supply supply to The Trade Desk’s platform.

AppLovin also announced that it will be the initially cellular in-application trade to support enable Unified ID 2. signals for taking part mobile publishers.

Furthermore, in March, The Trade Desk declared a new integration with Adobe Actual-Time CDP, a main consumer data platform.

Operating Aspects

Modified EBITDA in 1st-quarter 2022 surged 71.6% calendar year around 12 months to $121 million. Adjusted EBITDA margin was 38.4%, which expanded 630 foundation points (bps) on a yr-in excess of-year foundation.

Functioning bills jumped 56.8% calendar year about 12 months to $332.4 million, driven by bigger typical & administrative (G&A) costs, which soared 142.6% calendar year around yr to $125.8 million.

System operations expenditures were $63.9 million, up 26.5% calendar year in excess of 12 months. Income & Advertising and marketing (S&M) bills enhanced 26.8% from the prior-calendar year quarter’s ranges to $70.7 million. Technology & enhancement bills of $72 million greater 33.5% yr over 12 months.

As a share of revenues, G&A enhanced appreciably from the 12 months-ago quarter’s 23.6% to 39.9% in the reported quarter.

System functions, S&M and technology & enhancement expenditures declined 270bps, 300 bps and 17 bps to 20.3%, 22.4% and 22.8%, respectively.

Decline from functions was $17.1 million in opposition to the calendar year-ago quarter’s operating earnings of $7.8 million.

Balance Sheet

As of Mar 31, 2022, cash and money equivalents were being $1.10 billion as opposed with $959 million on Dec 31, 2021.

Steering

For second-quarter 2022, The Trade Desk expects revenues of at least $364 million.

On top of that, the company anticipates altered EBITDA to be roughly $121 million.

Zacks Rank & A Inventory to Look at

At present, The Trade Desk has a Zacks Rank #4 (Offer).

A better-rated inventory from the Zacks Pc and Technological innovation sector is Analog Units ADI, which carries a Zacks Rank #2 (Get). You can see the finish record of today’s Zacks #1 Rank (Sturdy Obtain) shares right here.

Analog Units shares have outperformed the sector calendar year to day, declining 11.7%. The sector has declined 26.9% in excess of the exact time frame.

ADI is established to report second-quarter fiscal 2022 effects on Might 18.

Want the most recent tips from Zacks Expense Exploration? Now, you can download 7 Very best Shares for the Next 30 Days. Click on to get this free report

Analog Equipment, Inc. (ADI) : No cost Inventory Evaluation Report

AppLovin Company (Application) : Free of charge Stock Evaluation Report

The Trade Desk (TTD) : Free of charge Inventory Investigation Report

LiveRamp Holdings, Inc. (RAMP) : Totally free Inventory Analysis Report

To examine this report on Zacks.com simply click right here.